Excitement About Guided Wealth Management

Table of ContentsGetting My Guided Wealth Management To WorkGuided Wealth Management Fundamentals ExplainedSome Known Facts About Guided Wealth Management.Guided Wealth Management Fundamentals ExplainedNot known Incorrect Statements About Guided Wealth Management

For investments, make settlements payable to the product service provider (not your consultant). Giving an economic adviser total access to your account raises danger.If you're paying a continuous suggestions fee, your advisor should evaluate your economic situation and meet you a minimum of once a year. At this meeting, make sure you go over: any modifications to your goals, circumstance or financial resources (including adjustments to your revenue, expenses or possessions) whether the degree of risk you fit with has actually changed whether your existing individual insurance cover is right exactly how you're tracking versus your goals whether any type of adjustments to legislations or economic items might influence you whether you have actually obtained every little thing they promised in your contract with them whether you need any modifications to your strategy Yearly a consultant must seek your written grant charge you continuous advice costs.

If you're moving to a new advisor, you'll need to organize to move your financial records to them. If you require aid, ask your adviser to explain the procedure.

Not known Details About Guided Wealth Management

As an entrepreneur or tiny company owner, you have a whole lot taking place. There are numerous obligations and expenditures in running a service and you certainly do not need an additional unneeded bill to pay. You need to meticulously consider the roi of any kind of services you reach see to it they are rewarding to you and your company.

If you are among them, you may be taking a huge risk for the future of your business and yourself. You may want to review on for a listing of reasons hiring an economic advisor is useful to you and your company. Running an organization teems with difficulties.

Cash mismanagement, cash money circulation issues, delinquent settlements, tax obligation concerns and various other financial problems can be essential adequate to shut a business down. That's why it's so essential to control the monetary elements of your company. Hiring a respectable economic advisor can prevent your business from going under. There are several methods that a certified economic expert can be your partner in assisting your company thrive.

They can work with you in reviewing your financial scenario regularly to avoid severe errors and to swiftly fix any kind of poor cash choices. The majority of small company owners put on several hats. It's easy to understand that you wish to save money by doing some work yourself, yet taking care of finances takes expertise and training.

See This Report about Guided Wealth Management

Planning A organization strategy is important to the success of your company. You require it to understand where you're going, how you're arriving, and what to do if there are bumps in the roadway. A great financial expert can assemble a comprehensive strategy to aid you run your business more successfully and get ready for anomalies that arise.

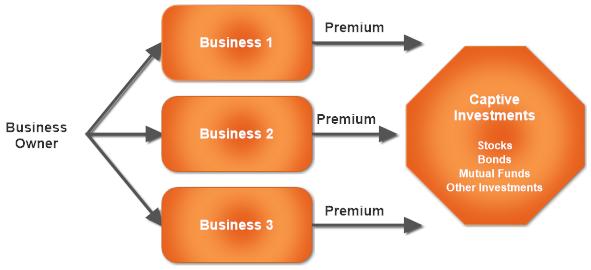

Wise investments are vital to accomplishing these goals. Many company owner either don't have the know-how or the moment (or both) to examine and evaluate investment chances. A trustworthy and well-informed monetary consultant can direct Get More Info you on the financial investments that are best for your organization. Money Financial savings Although you'll be paying a monetary expert, the long-term savings will validate the expense.

Reduced Stress and anxiety As a company proprietor, you have lots of things to stress around. A great financial consultant can bring you peace of mind knowing that your finances are obtaining the interest they require and your cash is being invested carefully.

The Best Strategy To Use For Guided Wealth Management

Stability and Growth A competent financial consultant can give you clarity and assist you concentrate on taking your company in the appropriate instructions. They have the tools and sources to utilize methods that will ensure your company grows and flourishes. They can aid you analyze your goals and figure out the most effective course to reach them.

The Single Strategy To Use For Guided Wealth Management

At Nolan Audit Facility, we supply know-how in all elements of monetary preparation for small businesses. As a small company ourselves, we understand the challenges you face every day. Offer us a telephone call today to discuss just how we can help your business thrive and do well.

Independent possession of the method Independent control of the AFSL; and Independent reimbursement, from the customer just, via a set buck fee. (https://www.folkd.com/profile/238458-guidedwealthm/)

There are countless benefits of an economic planner, no matter of your circumstance. The goal of this blog is to show why everyone can benefit from a financial plan. wealth management brisbane.

Comments on “The smart Trick of Guided Wealth Management That Nobody is Talking About”